WyCo Homeowner Tax Relief

Immediate relief needed for dozens of Wyandotte County residents at risk of losing their homes at the April 28th Tax Sale.

Leader

Monica Propst-Medeiros

Location

803 Armstrong Ave. Kansas City, KS 66101

About the project

On April 28th, 2022, the Tax Sale could potentially claim the homes of over 30 families and long-time Wyandotte County residents. A vast majority of homeowners that we have connected with are elderly, disabled, living on fixed incomes, or otherwise economically disadvantaged residents who have lived in our community for decades. The Covid-19 pandemic has also exacerbated the hardships that these families are facing, with unemployment, medical bills, and income inequality surging through the past several years. In order to pay each person's potential debt, we will need to raise approximately $100,000 to ensure that they will not be displaced from our community, or left with a monthly payment plan amount that is unaffordable.

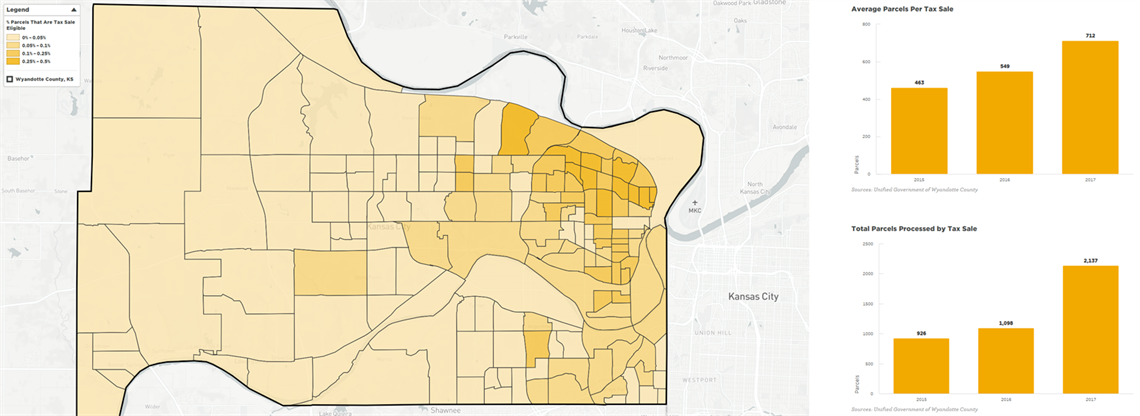

Background: An article was released by ABC News in early 2021 that depicted the plight of Wyandotte County homeowners who faced foreclosure in the county's tax auctions: https://abcnews.go.com/US/wireStory/black-neighborhoods-kansas-hard-hit-property-tax-sales-77286739. In July of 2021, Groundwork NRG and WyCo Mutual Aid began performing research and collecting data about Wyandotte County's tax auctions, and planned several canvassing events to understand the human impact of these sales. Although we wanted to focus exclusively on the Historic Northeast area of the county, we discovered that so many folks were in need of financial assistance that we decided to hit all 265 doors across the entire county who were enlisted for auction this past October.

Black neighborhoods in Kansas hard hit by property tax sales - ABC News

Results: Of the 265 doors we hit, approx. 20% of families across the county needed direct financial assistance to help pay their property taxes. We were able to make direct payments for 12 families in the Historic Northeast through funds we secured through crowd-funding, donations, and dollars that had been distributed to Community Housing of Wyandotte County. Our efforts did not end here however, as we met twice with county commissioners to advocate for a moratorium on the Tax Sales which would provide immediate relief for families that we had not yet secured funding to support. This advocacy was successful, and on October 26th, commissioners unanimously voted to postpone the October and January tax sales until April 2022: https://www.wycokck.org/Engage-With-Us/News-articles/Tax-Sales-Postponed-to-April-2022

The Steps

1. We are currently canvassing all 186 homes that are listed for auction at the April 28th Tax Sale.

2. Through this canvassing, we will identify what barriers each homeowner has faced to paying their annual taxes in full, if they have outside support to pay towards their debts, and if they require immediate financial assistance in order to remove their home from the upcoming sale.

3. Once the need is identified, we will work to secure donations, funds, and other financial resources to assist homeowners to pay their delinquent taxes. During this time, we will also work with individuals to address other immediate needs such as utilities, home repairs, and more.

4. Once funds are identified to assist with delinquent taxes, we will work with the Delinquent Real Estate Department within the Unified Government in order to make direct payments on behalf of each resident.

5. We will follow-up with residents to let them know that their taxes have been paid, and we will stay in touch with them throughout the year, and as capacity allows to ensure that they do not end up back in the tax sale.

Why we‘re doing it

Through spear-heading this initiative to assist homeowners in our area, we have witnessed the deep disparities that our community faces with regard to racial and economic inequality, and accessibility. While the purpose of the Tax Sale has been to tackle issues of vacancy, blight, and uncollected tax revenue which have caused harm to our area, something which has been objectively "successful," the current Tax Sale process inadvertently targets those individuals in our community who are most vulnerable, and risks long-term displacement for these members of our community. As Wyandotte County begins to attract more and more investors, developers, and outside attention that risks things like gentrification, and rising costs and property values, time is of the essence to ensure that all residents have the resources they need to comfortably age in place without fear that their homes will be sold out from under them for as little as a couple hundred dollars of debt.